Empower Your Financial Journey: Why Specialist Credit Rating Therapy Is Important

Expert credit score therapy offers as a valuable resource in this journey in the direction of economic security and success. The benefits of expert debt therapy expand far beyond just immediate economic alleviation.

The Impact of Credit Report Therapy

With tailored monetary assistance and organized financial debt administration strategies, professional credit score therapy substantially improves people' financial health and credit reliability. By offering customized approaches to resolve certain financial challenges, credit counselors encourage clients to take control of their financial scenarios and make informed choices. One of the key effects of credit rating counseling is the renovation in credit history. By enlightening individuals on just how credit score works and just how to utilize it responsibly, credit report counselors aid clients establish healthy monetary habits that can positively affect their credit reliability in time.

Furthermore, credit rating counseling can help people in creating effective budgeting skills and creating workable repayment prepare for their financial obligations. This not just lowers economic stress and anxiety but also helps individuals work towards ending up being debt-free. In addition, credit therapy can give important insights into credit rating report mistakes or inaccuracies, enabling customers to fix these concerns and boost their credit history accounts. Generally, the effect of specialist credit score therapy is profound, empowering people to accomplish higher financial security and success.

Financial Education and Awareness

One of the fundamental pillars of specialist debt therapy is the focus on financial education and learning and awareness. Comprehending individual money concepts such as budgeting, conserving, investing, and handling debt is crucial for individuals to make enlightened decisions about their financial wellness. Via professional debt counseling, people can acquire the understanding and abilities necessary to navigate the intricacies of the economic world and achieve their long-lasting economic objectives.

Financial education equips people to take control of their funds, make audio financial decisions, and plan for the future. It equips them with the tools to produce efficient budgeting methods, build savings, and handle financial debt sensibly. By raising monetary literacy and understanding, expert credit scores counseling aids individuals develop a deeper understanding of financial product or services, enabling them to make educated options that align with their monetary goals.

Additionally, economic education and learning plays an essential role in promoting economic stability and security. credit counselling services - EDUdebt. By fostering a culture of economic recognition, expert credit history counseling helps people stay clear of usual economic challenges, secure themselves from scams, and prepare for unanticipated costs. Eventually, purchasing economic education and learning via specialist credit score therapy can result in improved financial health and a much more protected financial future

Financial Obligation Management Strategies

Recognizing the value of economic education and awareness lays the structure for carrying out effective financial obligation monitoring techniques in professional debt counseling. Financial obligation monitoring methods are essential devices that can help people gain back control over their finances and work in the direction of becoming debt-free. One key method frequently used in credit report therapy is producing an organized repayment strategy customized to the individual's financial situation. This plan may involve discussing with creditors to lower rate of interest, consolidate financial debts, or established extra manageable settlement terms.

Along with repayment plans, credit counselors additionally concentrate on educating people concerning budgeting, saving, and accountable costs routines to stop future financial obligation troubles. By developing a strong monetary foundation and growing healthy monetary practices, individuals can not just tackle their existing financial obligations however also prevent dropping back into financial obligation in the future.

Additionally, financial obligation monitoring techniques in expert credit score therapy typically involve offering emotional assistance and support to individuals battling with debt-related stress. This holistic strategy addresses both the practical and emotional facets of financial debt management, empowering people to take control of their economic well-being.

Credit History Enhancement Techniques

When aiming to enhance one's credit history score, applying tactical economic methods contributes in achieving lasting monetary stability and reputation. One efficient strategy to increase a credit rating is to make certain prompt settlements on all charge account. Payment history holds substantial weight in identifying credit report, making it important to pay costs on time constantly. One more technique is to maintain charge card equilibriums reduced about the available credit line - credit counselling services - EDUdebt. Preserving an use rate listed below 30% shows liable credit history use and can favorably impact the credit report rating.

Regularly evaluating credit history records for mistakes and disputing any kind of mistakes is additionally essential for credit history renovation. Keeping an eye on debt records assists in recognizing possible concerns at an early stage and taking corrective activities promptly. In addition, limiting the number of new credit rating applications can protect against unneeded credit history questions that may adversely affect the credit rating. By carrying out these credit report renovation techniques Click This Link vigilantly, individuals can gradually enhance their creditworthiness and lead the way for far better monetary opportunities.

Long-Term Financial Planning

Expert credit scores counselors can provide experience in budgeting, financial obligation administration, and cost savings methods to aid people navigate complex financial decisions and stay on track towards their long-lasting objectives. By incorporating specialist credit score therapy into their monetary planning efforts, individuals can gain the expertise and tools essential to safeguard a secure economic future.

Final Thought

To conclude, professional credit rating therapy plays a critical role in empowering people on their monetary journey. By giving important insights, education and learning, and techniques, credit scores therapy can assist people handle their debt, enhance their credit history, and strategy for long-lasting financial security. Benefiting from professional credit scores therapy services can bring about considerable renovations in economic wellness and total monetary wellness.

Furthermore, restricting the number of brand-new credit report applications can avoid unnecessary credit history queries that might adversely affect the credit history rating.Enhancing one's credit report rating with critical economic techniques like timely repayments and credit usage monitoring lays a structure for efficient long-lasting monetary planning. By giving valuable understandings, education and learning, and approaches, credit therapy can help individuals handle their financial debt, enhance their credit report scores, and strategy for lasting monetary stability.

Rick Moranis Then & Now!

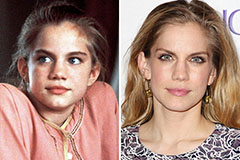

Rick Moranis Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!